Why a Planned Gift?

A planned gift allows donors to comprehensively live their values by integrating personal, family, charitable, and financial goals in a planned way. Over generations and today, Friends have used planned gifts like simple bequests, charitable gift annuities, charitable remainder trusts, donor-advised funds, gifts of stock, or IRA gifts, to provide very significant support to the Quaker faith. In addition to having tax advantages, charitable gift annuities and charitable remainder trusts also offer personal income or income benefits to named loved ones.

Friends Fiduciary is Philadelphia Yearly Meeting’s (PYM) planned giving partner.

Planned gifts are not just for the wealthy. They are the means through which ordinary people make extraordinary gifts that grow and build the future of the PYM community and our Quaker faith. Planned gifts to PYM can perpetuate annual fund giving, grow PYM’s endowment, or create a Legacy Fund gift.

The Legacy Fund is a permanently restricted endowment to which named gifts can be made. Annual income from the Legacy Fund supports annual operating costs. Brief life stories of honorees are conserved with the gift (minimum gift $1250).

Ways to Give

Bequests

Bequests are the foundation of PYM’s financial resources and fund about one million dollars in grants each year, as well as unrestricted income used for program and general purposes. Simple language that designates a percentage of your estate or a lump sum to PYM can be incorporated when you prepare a new will or update an existing one by codicil.

Sample Bequest Language

I give, devise, and bequeath to The Philadelphia Yearly Meeting of the Religious Society of Friends, a religious organization existing under the laws of the Commonwealth of Pennsylvania and located in Philadelphia, Pennsylvania,______% of the rest, residue and remainder of my estate (or the sum of $____________, to be used for general (or defined) purposes.

Contact us at (215) 241-7115 to learn about PYM’s gift acceptance and bequest policies.

When you inform us about your bequest intentions, you become part of PYM’s 1681 Society.

Designate a percentage of your IRA

Designating part or all of your IRA (or other qualified retirement account) is a ta advantageous way to effect a PYM bequest.

Simply contact your plan’s provider and specify the percentage you wish to designate to PYM along with the following information:

- Legal Name: Philadelphia Yearly Meeting of the Religious Society of Friends

- Tax ID number: 23-1352146

Gifts of Stocks or Appreciated Assets

Stocks or Appreciated Assets make tax smart gifts and bequests. If you sell appreciated securities, capital gains tax is owed on sale proceeds. By transferring appreciated securities directly to PYM for an annual fund donation or planned gift, you (1) can defer and/or avoid the capital gains tax and (2) can take a charitable deduction for all or a portion of the total fair market value of the securities contributed depending on the type of gift.

To gift appreciated securities to PYM, contact Friends Fiduciary (Tim McElroy) at tmcelroy@friendsfiduciary.org or call 215-241-7272.

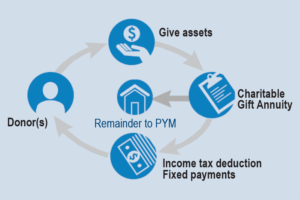

Charitable Gift Annuities

Charitable Gift Annuities provide a fixed lifetime income payment to you, and/or one/two other annuitants that you designate. As the donor you receive a charitable income tax deduction in the year of the gift. Charitable annuity rates are tied directly to the age of the annuitants at the time gifts are made. The minimum gift is $20,000.

Here is how it can work:

- Donor makes a cash gift of $20,000 or more.

- Donor receives a tax deduction based on current conditions.

- Annual income is provided during lifetime.

- After the death of the named annuitant(s), the remainder of the gift goes to PYM.

Access the Friends Fiduciary online gift calculator.

NOTE: Minimum gift (immediate or deferred) is $20,000; minimum age for annuitant(s) to receive payments is 65.

Deferred Payment Gift Annuities

A deferred charitable gift annuity defers the beginning of payments for a stated number of years. The donor receives an income tax deduction in the year of the gift, when your income might be higher. Deferral of payments entitles the annuitant(s) to a higher annuity rate/payment (after retirement) when funds will be needed. The remainder of the gift goes to Philadelphia Yearly Meeting.

Charitable Remainder Trusts

This type of planned gift works for gifts of $25,000 or more. Charitable remainder trusts provide fixed or variable income. The payout rate is determined jointly by the donor and Friends Fiduciary. Upon the death of the last income beneficiary, the balance of the trust’s assets will be given to PYM.

Donor-Advised Funds

These are created with a minimum gift of $25,000, which can be built up over three years. You receive a charitable income tax deduction for the year(s) in which the gift is made. Once the fund is established, you or your designated successors may advise Friends Fiduciary on grants to PYM. Friends Fiduciary oversees grant distribution, investment management and payout to the final charitable beneficiary.

Friends with donor-advised funds may designate annual or special purpose grants to PYM in support of the annual fund or particular PYM initiatives.

Partners In Planned Giving

Philadelphia Yearly Meeting partners with Friends Fiduciary Corporation on planned gifts for the benefit of PYM.

Philadelphia Yearly Meeting of the Religious Society of Friends was founded in 1681 to bring together Friends Meetings across a geographic area that includes parts of Pennsylvania and New Jersey, the Eastern Shore of Maryland, and Delaware.

Merri Brown

Director of Development

mbrown@pym.org

215-241-7115

Friends Fiduciary Corporation was founded by Quakers in 1898 to serve Quaker organizations and Friends meetings and churches. Today it offers investment management and charitable gift administration services to Philadelphia Yearly Meeting and other Quaker organizations.

Mimi Blackwell, JD

Director of Philanthropic Services

(215)-241-7272

Mblackwell@friendsfiduciary.org

Philadelphia Yearly Meeting and Friends Fiduciary do not provide legal or tax advice. When considering a gift, an attorney or tax advisor should be consulted.